When Nigerian angel investor Tomi Davies backed his first company — Strika Entertainment in 2001 — he admits he wasn’t aware of his future role.

“I was just helping out friends. I didn’t know it was angel investing. I didn’t know there was a structure to it,” he said.

Seven years later, Davies received a 20x return on his first exit and a decade after that he’s recognized as an architect of early-stage investing across Africa.

Davies is President of The African Business Angel Network and continues to fund and mentor young tech entrepreneurs in multiple countries.

On a call with TechCrunch, he shared advice for startups on fundraising, surviving COVID-19 and suggestions for global investors on entering Africa.

VC in Africa

Davies’ ascendance in fundraising runs parallel to the boom in startup formation and VC on the continent over the last decade.

When he began In 2001, there wasn’t much measurable venture or digital entrepreneurial activity in Sub-Saharan Africa, outside South Africa. In fact, there was limited data on VC investing on the continent until around five years ago.

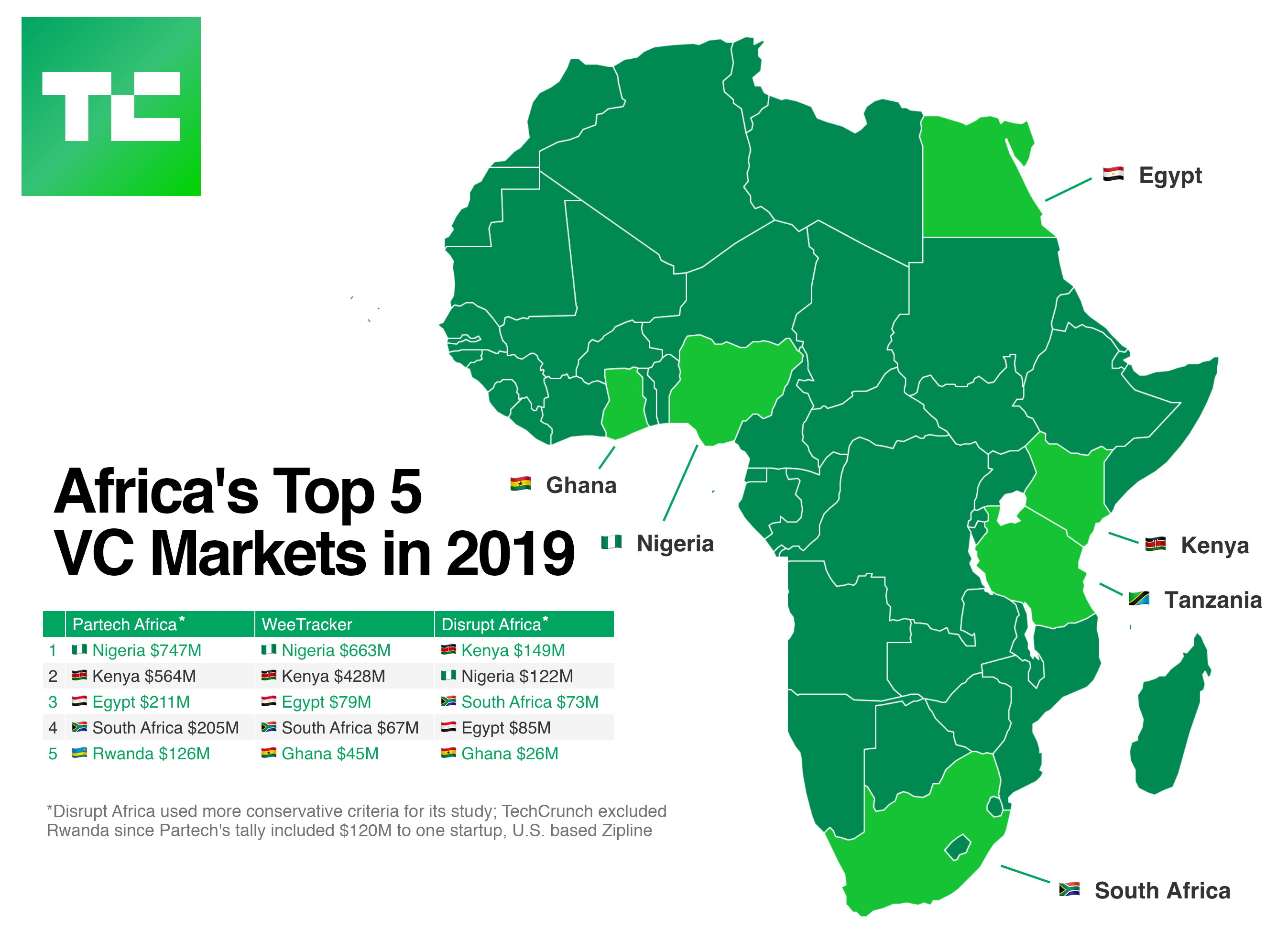

An early Crunchbase assisted study estimated VC to African startups annually grew from $40 million in 2012 to $500 million by 2015. A recent assessment by investment firm Partech tallied $2 billion going to the continent’s digital entrepreneurs in 2019, across top markets Nigeria, South Africa and Kenya.

Image Credits: TechCrunch

There are now thousands of VC backed startup entrepreneurs across the continent descending on every conceivable use-case — from fintech to on demand electric motorcycle mobility.

Increasingly, Davies’ home country of Nigeria has become the continent’s unofficial capital for venture investment and startup formation, given its market thesis of having Africa’s largest economy and population of 200 million people.

Even with the boom in VC to the continent’s startups — which has drawn investors such as Goldman Sachs and Steve Case — for years panels at African tech conferences have echoed the need for more early-stage funding options.

Davies has worked to meet that. He came to investing at the friends and family level after receiving an MBA at the University of Miami and an earlier career that spanned roles in management consulting, telecoms and IT.

After emerging as one of the early angels to Africa’s startups, supporting the continent’s innovation ecosystem became a mission for the Nigerian investor.

“My raison d’etre became, and will remain until the day I die, tech in African,” Davies said on a call from Lagos.

How to pitch

In his role as President of The African Angel Business Network, or ABAN, Davies has worked with a team to build out a local investor web across the continent.

“ABAN is very simply a network of networks…we have 49 networks in 33 African countries,” he explained.

Those include Lagos Angel Network, which Davies co-founded, Cairo Angels and Angel Investor Ethiopia, announced in Addis Ababa in 2019.

Tomi Davies (L) judges pitches with Cellulant CEO Ken Njoroge at Startup Ethiopia 2019, Image Credits: Jake Bright

ABAN establishes certain guidelines and criteria for how member networks operate, but each chapter sets its own investment terms, according to Davies.

For example, ABAN affiliated Dakar Angel Network — founded in 2018 to support startups in French speaking Africa — offers seed investments of between $25,000 to $100,000 to early-stage ventures.

Where and how startups seek funds from ABAN’s family of networks depends on where they operate. “One thing I say to everybody, from presidents to business people to investors, is Africa is about cities,” Davies said.

“When you know which city your looking to invest in or seek investment in, automatically we’ll be in a position to say, ‘here’s your network.'”

For the Lagos Angel Network in Nigeria, the team has a pitch night the third Thursday of each month with a 30 day rule. “Before you leave, you’ll hear if we’re interested or not. If we’re interested, we’ve got 30 days to make you an offer,” explained Davies.

Advice to startups

In addition to his work with ABAN, Davies continues to invest in his own portfolio of startups — now at 32 ventures — and is a regular judge on Africa’s tech competition circuit.

He’s developed a framework to assess companies and shared parts of it with TechCrunch.

Tomi Davies (center) at Startup Battlefield Africa 2017

“What I say to any startup raising is the first thing any investor is listening to is how do I get my money back. That’s question number one, ‘How do I get my exit?,'” he said.

Davies stressed three things to satisfy that question: “The product service offering that you have, the customers who see value in that product service offering and the nature of the relationship in terms of channel and price offering,” he said.

“That’s what you’re always tinkering with after you start with some kind of value proposition.”

Weathering recession

Davies referenced the increased significance of referrals, given the coronavirus has cancelled a number of events and limited mobility to pitch in person in Africa’s top VC markets.

“Because of COVID-19, networks have become critically important. Because investors can’t touch, can’t feel, can’t see [founders] people are looking now for referential integrity, ‘Who sent me this deck?,'” Davies said.

On how a coronavirus induced Nigerian recession may impact startups, Davies flagged the country’s non-stop informal commercial activity — and the adaptability of Nigerian entrepreneurs — as factors that could carry ventures through.

“There’s a significant chunk of the economy that’s in the informal market. So even if you look back at the recessions we’ve had…it hasn’t been felt on the streets,” he said.

Davies is also collaborating with partners on creating working capital solutions for startups whose revenues have been impacted by slowdown.

Co-investors

Tomi Davies is direct about his desire to draw new partners from tech centers such as Silicon Valley, into early-stage investing in Africa.

“We are always looking for co-investors and I speak on behalf of all 49 networks in ABAN,” he said. Davies highlighted the local expertise each network brings to their market as a benefit to VCs looking to invest on the continent through an African Business Angel Network affiliate.

"and" - Google News

June 05, 2020 at 02:24PM

https://ift.tt/3gT9s4R

Africa’s top angel Tomi Davies eyes startups and co-investors - TechCrunch

"and" - Google News

https://ift.tt/35sHtDV

https://ift.tt/2ycZSIP

And

Bagikan Berita Ini

0 Response to "Africa’s top angel Tomi Davies eyes startups and co-investors - TechCrunch"

Post a Comment