onurdongel

Investment thesis

My thesis has been validated and reinforced by Symbotic Inc. (NASDAQ:SYM) 2Q23 results. Before we get to that, I am surprised by how strong the SYM stock price momentum was ever since I wrote about it. I had a price target of $20.54, or 31% upside in February, but the stock has risen to an all-time high of $35 yesterday, outperforming my expectation significantly. I believe the combination of a very strong 2Q23 performance, and the updates provided in the recent Investor Day, were the cause of this strong price action.

By way of background on 2Q performance, SYM 2Q23 revenue of $267 million surpassed expectations by 10%, and EBITDA of -$11.2 million surpassed expectations by 30%. The high backlog of $12 billion at the end of the quarter supports my view that the company has a promising opportunity to grow its top line. In fact, I consider the $12 billion backlog to be the bare minimum from which we can reasonably anticipate growth, given Symbotic Inc.'s potential for attracting new customers and expanding into new markets.

All is good, except that I think valuation is too high now. As such, I am recommending a hold rating (changing from my buy rating previously).

Symbotic Service Addressable Market

One of the most important things I took away from the Analyst day was management's estimate for SYM potential service addressable market [SAM], which was increased by $39 billion, from $393 billion to $432 billion. Considering how effectively SYM solution handles the problem of labor shortages and how easily its technology can be retrofit into existing warehouses, I believe the market is starting to see the substantial value proposition it offers. In my opinion, the SAM was raised because management is hearing positive feedback and seeing rising demand.

The SYM solution incorporates many important features, as will become clear. To begin with, it has robots that are specifically programmed to safely handle packages. In addition, with the help of AI, incoming packages can be efficiently sorted, with damaged ones being rejected. In my opinion, one of SYM most appealing qualities is its capacity to construct dense pallets that are designed for speedy loading onto tractor trailers and simple unloading at retail outlets. All of these factors contribute to one result: less need for human labor – which is a hot issue in the market today given the tight labor environment.

Margins

As Symbotic Inc. grows and becomes more efficient, I have no doubt that its profit margin will increase. Scale helps here because it expands SYM's reach and lowers unit costs, but I think it's important to remember that the company is still relatively new despite its rapid expansion. I have faith that over time (growth is the focus now rather than cost optimization), management will identify areas of the cost structure where optimization could result in greater operating/cost efficiency. All of these factors ought to sustainably fuel future margin growth.

Furthermore, I believe the P&L today does not accurately reflect the underlying mix shift impact, as the legacy projects have lower margins. Projects in the company's backlog have expected structural lifetime margins of roughly 40%, as stated by management. However, these margins can reach as high as 50% for new customers (i.e., new projects carry higher margins). Also, since SYM is still in the growth stage, this trend toward a greater contribution from system and hardware sales to total revenues is likely to persist for some time. I expect that that profit margins will improve once software and service revenue makes up a larger share of total revenue.

Valuation

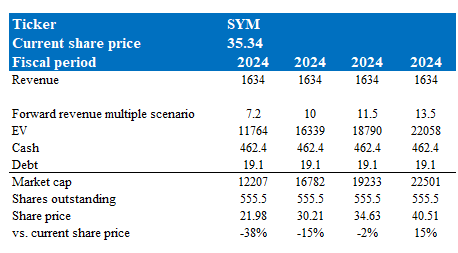

My primary concern about Symbotic Inc. stock is its current valuation. The stock was trading at 7.2x forward revenue when I last wrote about it, but it is now trading at nearly double that figure (13.5x forward revenue). While I recognize that revenue is rapidly increasing and thus deserves a premium, I am unsure of the appropriate multiple at which this should trade. When we consider the various scenarios in which SYM could trade, the risk/reward does not appear to be very appealing, unless one is convinced that multiples can rerate higher (which I am not). As a result, I recommend a hold.

Own estimates

Risks

The primary risk is that Symbotic Inc. results could be significantly affected by changes in the pace of buildouts for SYM's largest customer (Walmart). Second, with the current state of the global supply chain, I have some reservations about SYM's ability to convert its backlogs into revenue in a timely manner. If it is unable to implement these changes at the rate anticipated by the market, the valuation may drop as consensus revise their price targets downwards.

Conclusion

The strong Symbotic Inc. performance in 2Q23, along with the positive updates provided during the Investor Day, have validated my investment thesis. I expect the Symbotic Inc. business to continue growing and capturing a larger market, while improving its profit margins over time – as the company becomes more efficient and also benefit from the underlying mix shift impact. However, I believe Symbotic Inc. stock's valuation is now too high, leading me to change my rating to a hold.

"with" - Google News

May 27, 2023 at 04:26AM

https://ift.tt/PjIleQ3

Symbotic: Larger Market With Good Margin Outlook (Rating Downgrade) (NASDAQ:SYM) - Seeking Alpha

"with" - Google News

https://ift.tt/4CLcMEV

https://ift.tt/YuMzkiZ

Bagikan Berita Ini

0 Response to "Symbotic: Larger Market With Good Margin Outlook (Rating Downgrade) (NASDAQ:SYM) - Seeking Alpha"

Post a Comment