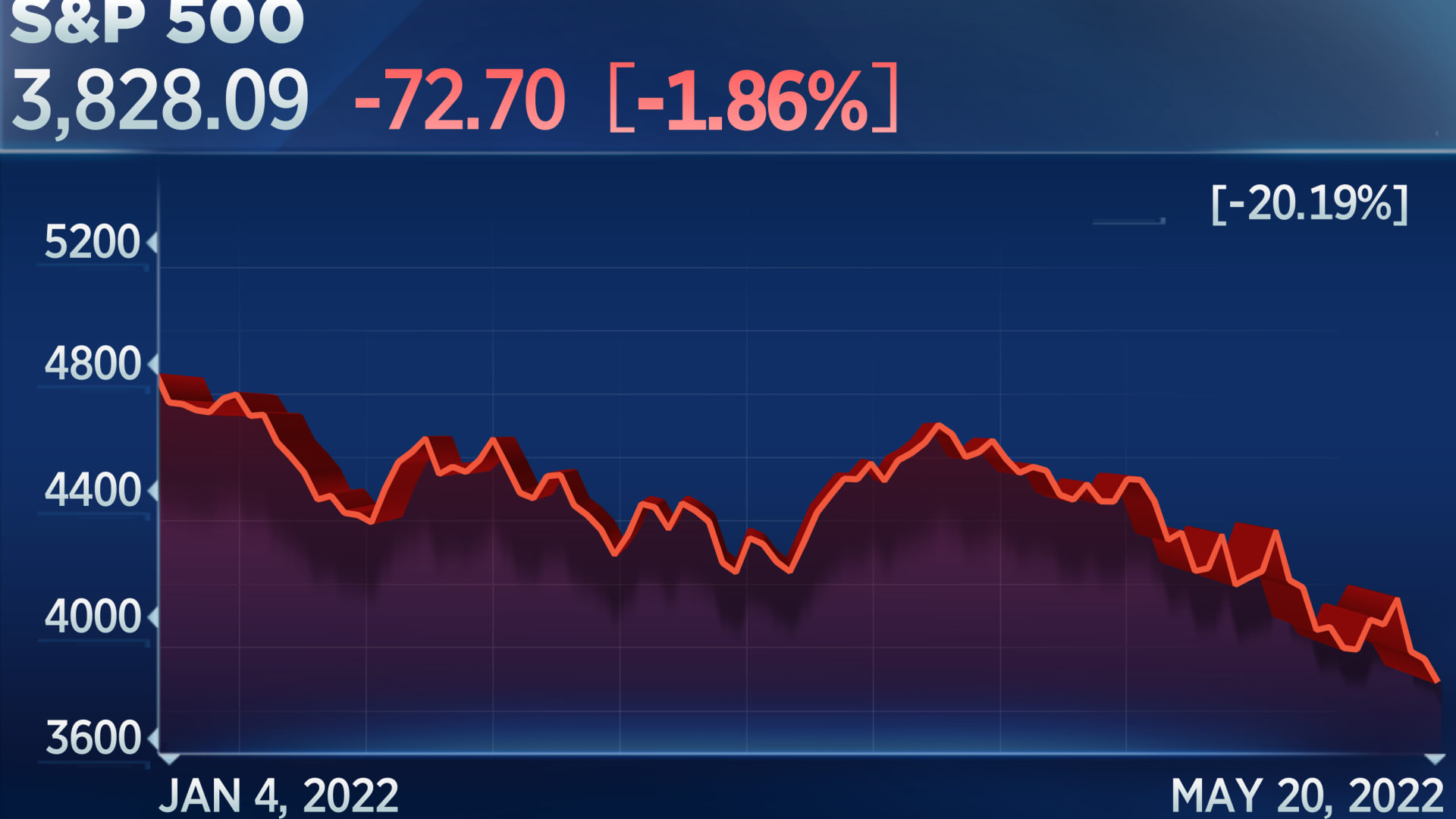

Rising recession fears pushed U.S. stocks into a bear market on Friday with the S&P 500's decline from its all-time high in January now reaching 20%.

The S&P 500 dropped 1.7% on Friday, putting the benchmark for U.S. stocks 20.7% below its intraday record reached in January. The index is now headed for a close that's more than 20% below its January record closing level as well.

So to most on Wall Street, this is now the first bear market to hit since the rapid decline in March 2020 at the onset of the pandemic.

"Stocks are still liberally priced and the psychology that drove them upward for a decade has turned negative," wrote George Ball, chairman at investment firm Sanders Morris Harris. "The average bear market lasts a year (338 days, more precisely). This downturn has run for only one-third of that, so it probably has more downside room to run, albeit punctuated by interim rallies."

Now that the S&P 500 is down 20% from its highs, that puts the start of the bear market at early January.

The Dow Jones Industrial Average fell 455 points, or 1.5%, with the benchmark dropping despite a strong open. The Nasdaq Composite dipped 2.2% and is already deep in bear market territory, trading 31% off its highs.

For the week, the Dow is off by 4% for what would be its first 8-week losing streak since 1923. The S&P 500 is down 5% for the week, while the Nasdaq is off by 6%. Both indexes are on pace to fall for a seventh-straight week.

"This week's decline felt as if the market was starting to recognize that earnings growth and S&P 500 profitability may be in jeopardy as inflation will continue to be higher throughout the year," wrote David Wagner, portfolio manager at Aptus Capital Advisors.

Biggest S&P 500 losers during bear

| Ticker | Company | % off 52-week high |

|---|---|---|

| ETSY | Etsy | 75.4% |

| PYPL | PayPal | 74.6% |

| NFLX | Netflix | 74.1% |

| MRNA | Moderna | 73.0% |

| UAA | Under Armour | 66.0% |

| PENN | Penn National Gaming | 64.6% |

| ALGN | Align Technology | 63.4% |

| CZR | Caesars Entertainment | 60.2% |

| GNRC | Generac | 59.6% |

Source: FactSet

The S&P 500's tumble into a bear market comes as the U.S. has been dealing with inflationary pressures not seen in decades. Those have been worsened by a surge in energy prices — which was exacerbated in large part by the start of the Ukraine-Russia war.

The jump in inflation then led to the Federal Reserve hike rates in March for the first time in more than three years. Earlier this month, the central bank got even more aggressive and hiked rates by half a percentage point.

At first, the sell-off losses were centered around highly valued growth and technology stocks. However, the sell-off eventually broadened to other parts of the market. Through midday Friday, energy was the only positive S&P 500 sector year to date.

Biggest Nasdaq losers in the bear market

| NAME | TICKER | % OFF 52-WEEK HIGH |

|---|---|---|

| Zoom Video Communications | ZOOM | 78.64% |

| DocuSign | DOCU | 76.55% |

| PayPal Holdings | PYPL | 74.65% |

| Netflix | NFLX | 74.19% |

| Moderna | MRNA | 73.14% |

| Pinduoduo | PDD | 71.99% |

| Lucid Group | LCID | 69.25% |

| Zscaler | ZS | 64.44% |

| Align Technology | ALGN | 63.51% |

| Match Group | MTCH | 58.69% |

Source: FactSet

Then this week, poor quarterly reports and outlooks from Walmart and Target raised concern over companies' abilities to deal with inflation and consumers' willingness to pay higher prices — putting even more pressure on the S&P 500.

"At some point the market will turn, but it won't be until these winds are shifting, inflation is coming down and consumers are feeling good about spending money again like they want to and are used to. These are pretty long cycles," said Johan Grahn, head of ETF strategy at Allianz Investment Management.

The March 2020 bear market lasted just 33 days before the S&P 500 ended up rebounding to record highs again as investors bet on internet companies which thrived during the pandemic.

Loading chart...

Wall Street continued dumping shares of semiconductor stocks Friday on recession fears. Shares of Nvidia fell 5%, Advanced Micro Devices declined 4%, and Marvell Technology slipped more than 2%.

Bank stocks declined on those same fears. Shares of JPMorgan Chase dropped 2% and Bank of America fell nearly 4%.

Elsewhere, shares of Deere fell nearly 14% on Friday after the heavy equipment maker reported a revenue miss. Shares of Caterpillar declined more than 5%. Industrials like Deere and Caterpillar are seen as barometers for the global economy.

Meanwhile, the Fed has signaled it will continue to raise interest rates as it tries to temper the recent inflationary surge. Earlier in the week, Chair Jerome Powell said: "If that involves moving past broadly understood levels of neutral, we won't hesitate to do that."

That tough stance on monetary policy has stoked concern this week that the Fed's actions could tip the economy into a recession. On Thursday, Deutsche Bank said the S&P 500 could fall to 3,000 if there is an imminent recession. That's 23% below Thursday's close.

According to Sam Stovall, chief investment strategist at CFRA Research, "There's a possibility we can see this bear market bottom out in the upper 20% area, so remain less than a 30% bear market, but you know between 25 and 30%."

— CNBC's Jeff Cox, Jesse Pound and Samantha Subin contributed to this report.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

Correction: The Dow was on pace for its first eight-week losing streak since 1923. A previous version misstated the year.

"with" - Google News

May 20, 2022 at 05:01AM

https://ift.tt/T5Jr76H

Stocks fall into bear market with S&P 500 now off 20% from record - CNBC

"with" - Google News

https://ift.tt/SaNtQpB

https://ift.tt/XONob6z

Bagikan Berita Ini

0 Response to "Stocks fall into bear market with S&P 500 now off 20% from record - CNBC"

Post a Comment