Four storage suppliers reported quarterly results, providing a return-to-growth or decline-stopping snapshot across the industry. They were all-flash array supplier Pure Storage, hyperconverged systems vendor Nutanix, broad-based systems incumbent Dell Technologies, and high-flying cloud data warehouse vendor Snowflake.

Pure Storage

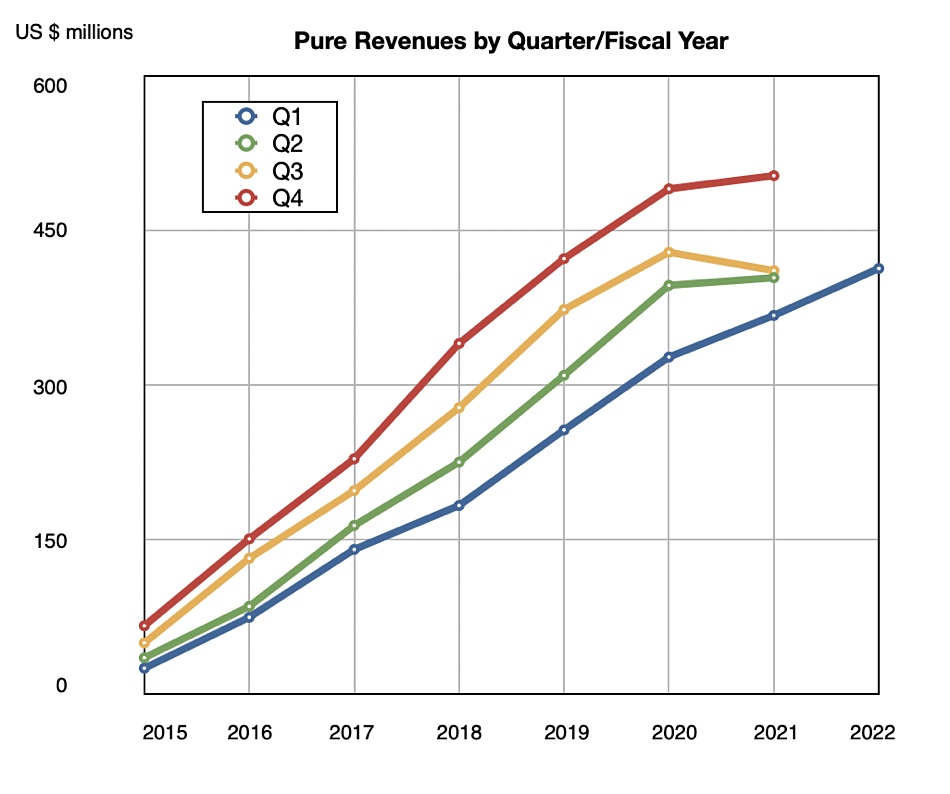

All-flash array and cloud-like digital experience provider Pure announced a return to double-digit growth. Revenues in its fiscal 2022 Q1, ended May 2, were $412.7m, 12.4 per cent more than a year-ago, but with a net loss of $84.2,m, slightly better than last year’s $90.6m loss. Pure gained 330 new customers in the quarter, taking its total to 9,267, and subscription services revenue grew 35 per cent Y/Y to $162.8m.

Kevan Krysler, Pure’s CFO, said: “We are very pleased with the strong start to the year returning to double digit revenue growth. Broad-based performance in the quarter included early signs of strength in our commercial business and continuing accelerated momentum of FlashArray//C.”

Seasonally, Pure’s first quarter has always been a high-growth period. Its fiscal 2021 saw growth flattening in Q2, turning negative in Q3 but returning to positive status in Q4. Now, in Q1, growth has accelerated and is set to do so again in Q2, with Pure forecasting revenues of $470m.

That would represent a 16.4 per cent uplift from a year ago.

Nutanix

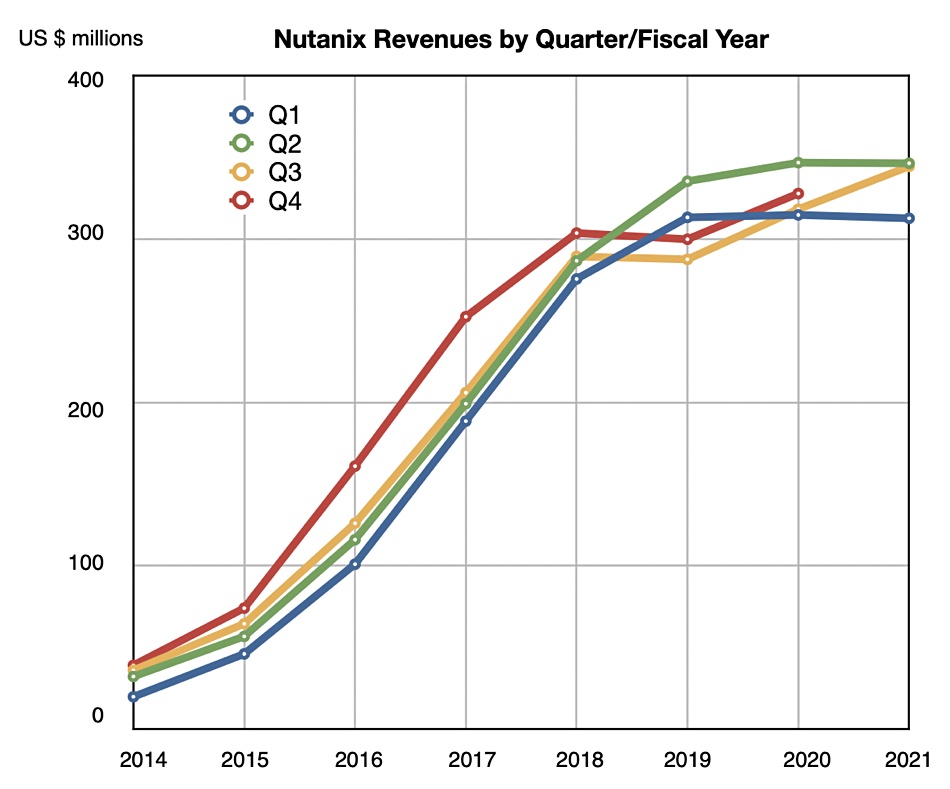

Hyperconverged systems and subscription-focused vendor Nutanix reported Q3 fy21 earnings, ended April 30, with revenues of $344.5m, up 8 per cent Y/Y. It had a bigger net loss than Pure, $123.6m, but this was a massive improvement on the year-ago $240.6m loss. However, cost controlling is apparent and a 2.5 per cent sales and marketing headcount layoff round was announced.

William Blair analyst Jason Ader commented: “Nutanix reported a solid beat-and-raise in its fiscal third quarter, as the company continues to make progress in its ACV transition and HCI demand benefits from an improving macro environment.”

A chart of its quarterly revenues by fiscal year shows, in contrast to Pure, three years of muted growth. This started in its fiscal 2019, with a recovery in fy20 that was blown off course by the Covid-19 pandemic. Now there are signs of a renewed recovery.

The company gained 660 new customers, taking its total customer count to 19,430. Annual Contract Value (ACV) billings rose 18 per cent Y/Y to $159.9m.

Nutanix CFO Dustin Williams said: “We saw record ACV billings, with growth accelerating to 18 per cent year-over-year, while our disciplined spending delivered operating expenses below our guidance. Our growing renewals pipeline will help to drive future top line growth, offer substantial sales and marketing efficiencies, and increase the predictability in our business.”

Nothing in that about profitability but some details are expected at a forthcoming investors’ day meeting.

Ader said: “The company’s key lever to get to cash breakeven is its steadily building renewal base, which should drive structural improvements in operating leverage over time. Ultimately, we think patient investors will be rewarded here as the company is on a better growth footing, the stock is not expensive, and there is preliminary line of sight to improved profitability.”

Nutanix expects next quarter’s ACV billings to be between $170m and $175m; it’s not providing a direct revenue guide. Ader estimates Q4 revenues will be $339.7m, a 3.6 per cent Y/Y rise

Dell Technologies

Dell Technologies had a record first 2021 quarter, ended April 30, with revenues up 12.5 per cent to $24.5bn, up 12.5 per cent. There was a $938m profit, up an astounding 415 per cent Y/Y.

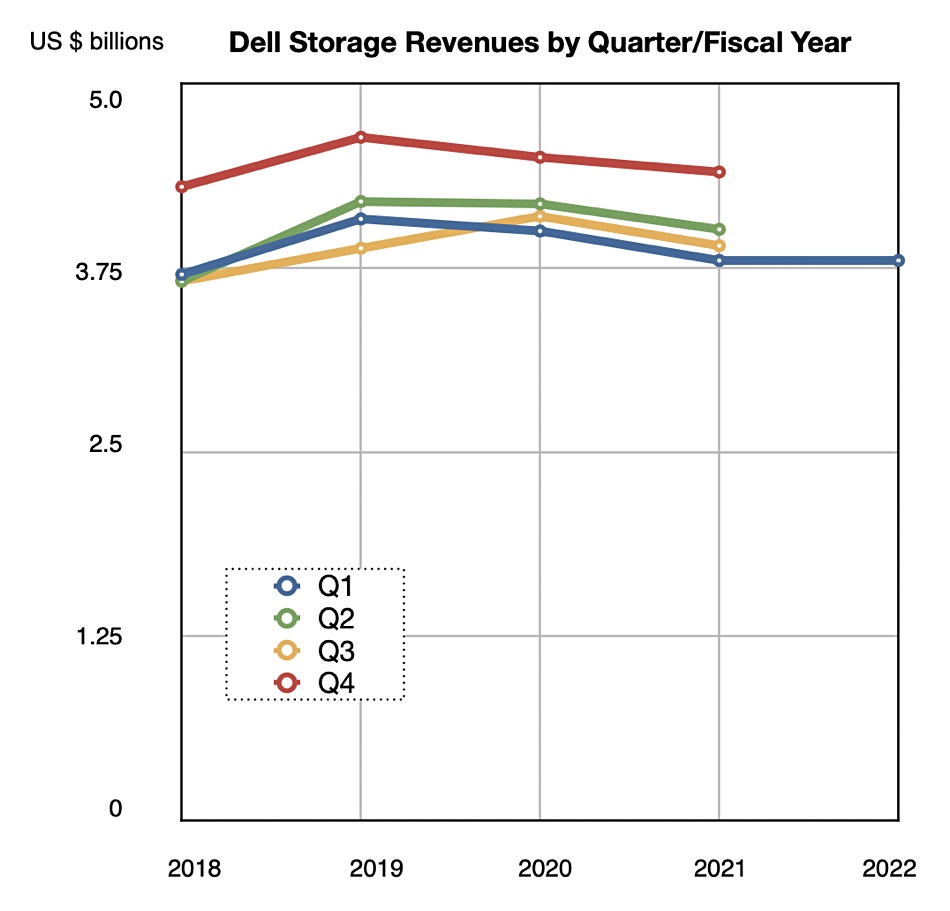

VMware contributed $3bn, 9 per cent more than a year ago. Dell’s ISG (Infrastructure Solutions Group) reported $7.9bn in revenues, up 5 per cent Y/Y. Servers and networking contributed $4.1bn, up 9 per cent, but storage was flat Y/Y at $3.8bn. To put that in context, Dell’s storage revenues are more than 10 times higher than Nutanix’s revenues and 9.2 times Pure Storage’s revenues.

Why were Dell storage revenues a no-growth area? Wells Fargo analyst Aaron Rakers said: “Dell reported strong orders in the quarter for HCI and mid-range – each up 23 per cent y/y driven by VxRail and PowerStore. The company noted that its storage buyers were up 12 per cent y/y in the quarter, while 25 per cent of PowerStore purchasers were new to Dell.” But “PowerMax declined amid tougher comps and Isilon unstructured / file results were weaker).”

The high-end PowerMax arrays have competitors such as Infinidat and VAST Data. Isilon scale-out filesystems are being replaced by Dell’s new PowerScale line and face competition from Qumulo, NetApp and others. Ader commented: “We believe investors will continue to question Dell’s ability to return to sustainable growth in the storage business.”

A chart shows Dell’s stalled quarterly storage revenues since 2019. At least the flat Q1 fy22 revenues end five consecutive quarters of declining revenues.

Dell is guiding a 6 per cent sequential revenue increase for its next quarter, meaning $25.97bn.

Snowflake

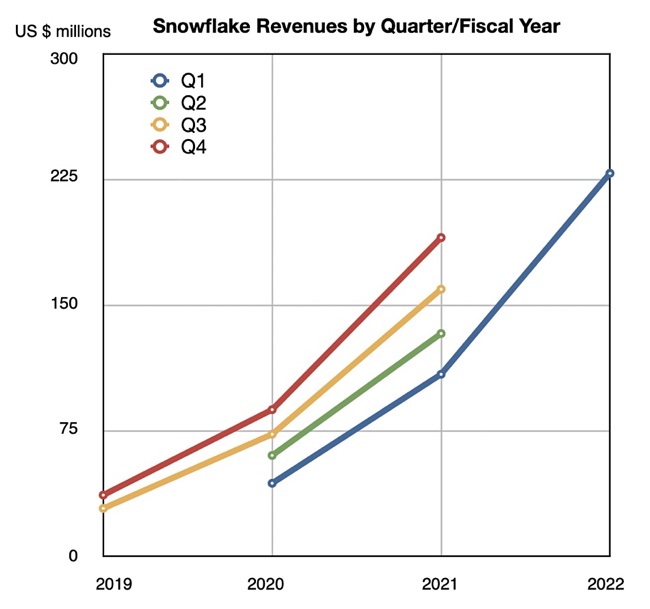

Snowflake reported accelerated Y/Y revenue growth in its first fiscal 2022 quarter, ended April 30, up 110 per cent to $228.9m, with a more than doubled net loss of $203.2m. It won 384 new customers taking its tally to 4,532, and 104 customers with trailing 12-month product revenue greater than $1m. Product revenues were $213.8m, also up 110 per cent Y/Y.

CEO Frank Slootman said: “Snowflake reported strong Q1 results with triple-digit growth in product revenue, reflecting strength in customer consumption. Remaining performance obligations showed a robust increase year-on-year, indicating strength in sales across the board.”

The company said it has a steadily improving gross margin, with 63 per cent in its fy 20, 69 Oper cent in fy21 and 72 per cent in this latest quarter.

Next quarter’s revenue outlook is $235 – $240m, which would be a 78.4 per cent rise at the mid-point.

Comment

Snowflake’s revenues are the smallest of our four suppliers but growing at at a much faster rate and set to overtake both Nutanix and Pure if its growth continues at a 50 per cent-plus rate. The $203.2m loss indicates it, like Pure and Nutanix, is in a dash for growth at the expense of profitability. However, Nutanix is sending out signals indicating it’s preparing to rate profitability higher.

Pure is still prioritising growth over profitability. At some stage it too will have to reset that priority, presumably when its revenue growth prospects settle down at a lower level.

Dell is by far the biggest player in our group of four. If it can reverse the decline in the PowerMax and get the newly launched PowerScale growing then it too should see storage growth.

"and" - Google News

June 01, 2021 at 08:55PM

https://ift.tt/34zxooT

A revenue tale of four storage cities: Pure, Nutanix, Dell and Snowflake – Blocks and Files - Blocks and Files

"and" - Google News

https://ift.tt/35sHtDV

https://ift.tt/2ycZSIP

And

Bagikan Berita Ini

0 Response to "A revenue tale of four storage cities: Pure, Nutanix, Dell and Snowflake – Blocks and Files - Blocks and Files"

Post a Comment